Business News

Corporates make 73% of public sector bank bad loans

The Finance Ministry directed smaller PSBs to cut their corporate loan exposure to 25 per cent of their risk-weighted assets over the medium term and focus more on retail lending.

Corporate loans corner the lion’s share of rising bad loans in public sector banks while retail loans have a far superior track record when it comes to timely repayment, according to the latest available Reserve Bank of India data.

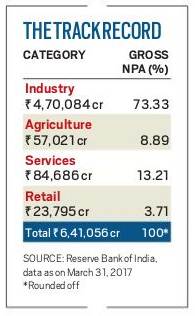

Even as public sector banks lent about 37 per cent of their total credit to the industry sector, the corporate and industry loans accounted for over 73 per cent of the total non-performing assets (NPAs) of the banking sector in 2016-17, according to an analysis of the data.

Retail loans, which are 22.83 per cent of the overall credit, comprised only 3.71 per cent of the gross NPAs.

Banking analysts say that factors such as business failure, inadequate risk assessment while sanctioning corporate credit and loan frauds by companies are some of the main reasons for the high level of NPAs in loans to industry given by the banks.

In contrast, retail loans such as home loans, car loans and personal loans have a much better repayment track record. Loans to services and agriculture sector accounted for 13.21 per cent and 8.89 per cent respectively of the gross NPAs, the data shows.

In absolute terms, out of Rs 6.41 lakh crore worth of total gross NPAs of PSU banks, Rs 4.70 lakh crore worth of NPAs were due to loans extended to industry as on March 31, 2017, the data shows. As for retail loans, Rs 23,795 crore worth of such loans turned into NPAs.

In absolute terms, out of Rs 6.41 lakh crore worth of total gross NPAs of PSU banks, Rs 4.70 lakh crore worth of NPAs were due to loans extended to industry as on March 31, 2017, the data shows. As for retail loans, Rs 23,795 crore worth of such loans turned into NPAs.

To put PSU banks in order, the government initiated a plan in January to turn some of the smaller PSBs into national retail banks and regional retail banks, while limiting the corporate loans business primarily to large banks such as the State Bank of India, Punjab National Bank and Bank of Baroda.

The Finance Ministry directed smaller PSBs to cut their corporate loan exposure to 25 per cent of their risk-weighted assets over the medium term and focus more on retail lending.

For a number of PSBs, the corporate loan exposure is around 50 per cent or higher, while retail exposure is around 15 per cent. In the roadmap towards reaching the 25 per cent corporate loan exposure mark, the government has asked smaller banks to first cut their corporate loan exposure to either below 40 per cent by March 2019 or by at least 15 per cent from the September 2017 level.

A closer look at the data shows that within the industry, large corporates account for a bigger chunk of NPAs. The gross NPAs under the industry-large category for scheduled commercial banks, which were Rs 1.23 lakh crore as on March 31, 2015, ballooned to Rs 5.27 lakh crore in December 31, 2017.

In 2015, the RBI initiated its Asset Quality Review in order to have fully provisioned bank balance-sheets by March 2017. This transparent recognition of bad loans showed the actual picture of stressed assets in the economy.

In terms of the Gross NPA ratio for large industry as on December 31, 2017, Indian Overseas Bank had the highest ratio of 44.29 per cent, IDBI Bank had a ratio of 42.69 per cent, State Bank of India 25.09 per cent, Allahabad Bank 36.94 per cent, Bank of Maharashtra 36.58 per cent, ICICI Bank 20.83 per cent. This means that for every Rs 100 loan given to a large corporate by Indian Overseas Bank, as much as Rs 44.29 turned into NPA.

In contrast, private lender HDFC Bank, which focuses on retail lending, had a Gross NPA ratio of only 0.74 per cent for large corporate loans.

Another private lender Yes Bank, which focuses on corporate loans, had a gross NPA of 3.28 per cent for its exposure to large corporates.

The government has announced that it will follow a differentiated strategy of capital infusion, which means that the size of smaller banks will be reduced, gearing them towards lending primarily to retail with asset swaps and pruning the number of unprofitable branches.